Federal Tax Breaks Available For Some Derecho Victims

A series of federal tax breaks are now available for many Iowans who took a financial hit from last summer’s derecho. The new law waives penalties for individuals who make early withdrawals from their retirement savings to pay for storm-related expenses. Businesses in the derecho zone that had to close temporarily, but kept paying their employees, are eligible for a tax credit. Low-income workers that had their hours cut will be able to use their 2019 income to calculate tax credits they would otherwise lose or see dramatically reduced. There are some changes in the deduction for charitable giving, to encourage donations that support derecho recovery. These tax changes originally were in a bill introduced by Iowa Senator Joni Ernst that was later added to the huge piece of legislation President Trump signed in late December. These tax changes are aimed at providing needed relief for Iowa families, communities, and businesses impacted by the derecho.

Local Events Calendar

Calendar of Events

M Mon

T Tue

W Wed

T Thu

F Fri

S Sat

S Sun

0 events,

1 event,

BIG DAWG BINGO

BIG DAWG BINGO

Almost Home Humane Society will be facilitating Bingo every Tuesday night from 6-10 PM at the Laramar […]

1 event,

MANSON FIREFIGHTERS ANNUAL RIBEYE STEAK DINNER FUNDRAISER

MANSON FIREFIGHTERS ANNUAL RIBEYE STEAK DINNER FUNDRAISER

THE MANSON FIREFIGHTERS ANNUAL FUNDRAISER IS WEDNESDAY, APRIL 3RD FROM 5 UNTIL 10 AT BIG BEVES IN […]

3 events,

Fort Dodge Study Club Annual Event Celebrating Sprouts Early Education & Development School (SEEDS)

Fort Dodge Study Club Annual Event Celebrating Sprouts Early Education & Development School (SEEDS)

The Fort Dodge Study Club is a local group that was formed in 1935 and has been […]

Fort Dodge Public Library Book Club

Fort Dodge Public Library Book Club

THE FORT DODGE PUBLIC LIBRARY WILL HAVE THEIR SECOND MEETING OF THE YAY BOOK CLUB, THURSDAY, APRIL […]

FORT DODGE STUDY CLUB EVENT

FORT DODGE STUDY CLUB EVENT

THE FORT DODGE STUDY CLUB CELEBRATES SPROUTS EARLY EDUCATION AND DEVELOPMENT SCHOOL OR SEEDS, THURSDAY, APRIL 4TH […]

1 event,

St Paul Lutheran School DJ Bingo Fundraiser

St Paul Lutheran School DJ Bingo Fundraiser

Join us in the St Paul Lutheran Church Fellowship Hall April 5, 2024 at 5:30pm. Silent Auction, […]

1 event,

FIRST ANNUAL DEVILED EGG-OFF

FIRST ANNUAL DEVILED EGG-OFF

STRATFORD STRIDE AND RUNGOS INVITE YOU TO THE FIRST EVER DEVILED EGG-OFF, SATURDAY, APRIL 6TH AT RUNGOS […]

1 event,

Harcourt Fire and Rescue Pancake Breakfast

Harcourt Fire and Rescue Pancake Breakfast

BE AT THE HARCOURT COMMUNITY CENTER, SUNDAY, APRIL 7TH FOR THE ANNUAL HARCOURT FIRE AND RESCUE PANCAKE […]

0 events,

1 event,

BIG DAWG BINGO

BIG DAWG BINGO

Almost Home Humane Society will be facilitating Bingo every Tuesday night from 6-10 PM at the Laramar […]

0 events,

0 events,

0 events,

3 events,

Kosovo Fundraiser Scavenger Hunt

Kosovo Fundraiser Scavenger Hunt

THE FORT DODGE SISTER CITY YOUTH EXCHANGE WILL HAVE A KOSOVO FUNDRAISER SCAVENGER HUNT, SATURDAY, APRIL 13TH […]

40th Anniversary Fur Ball

40th Anniversary Fur Ball

Join us for a night of fun, food, and fundraising to benefit the homeless pets at Almost […]

Johnny Cash and June Carter tribute show

Johnny Cash and June Carter tribute show

The What Cheer Opera House presents Bennie Wheels & "Walkin' The Line", the ultimate tribute to Johnny […]

1 event,

KING RINGERS HANDBELL CONCERT

KING RINGERS HANDBELL CONCERT

THE KING RINGERS HANDBELL ENSEMBLE SPRING CONCERT WILL BE HELD, SUNDAY, APRIL 14, 2024, AT 4 P.M., […]

1 event,

Lehigh Public Library “Bar” Crawl and Mocktails

Lehigh Public Library “Bar” Crawl and Mocktails

Submit your best bar recipe by Tuesday April 9, 2024 to participate in this program. *Please list […]

1 event,

BIG DAWG BINGO

BIG DAWG BINGO

Almost Home Humane Society will be facilitating Bingo every Tuesday night from 6-10 PM at the Laramar […]

0 events,

1 event,

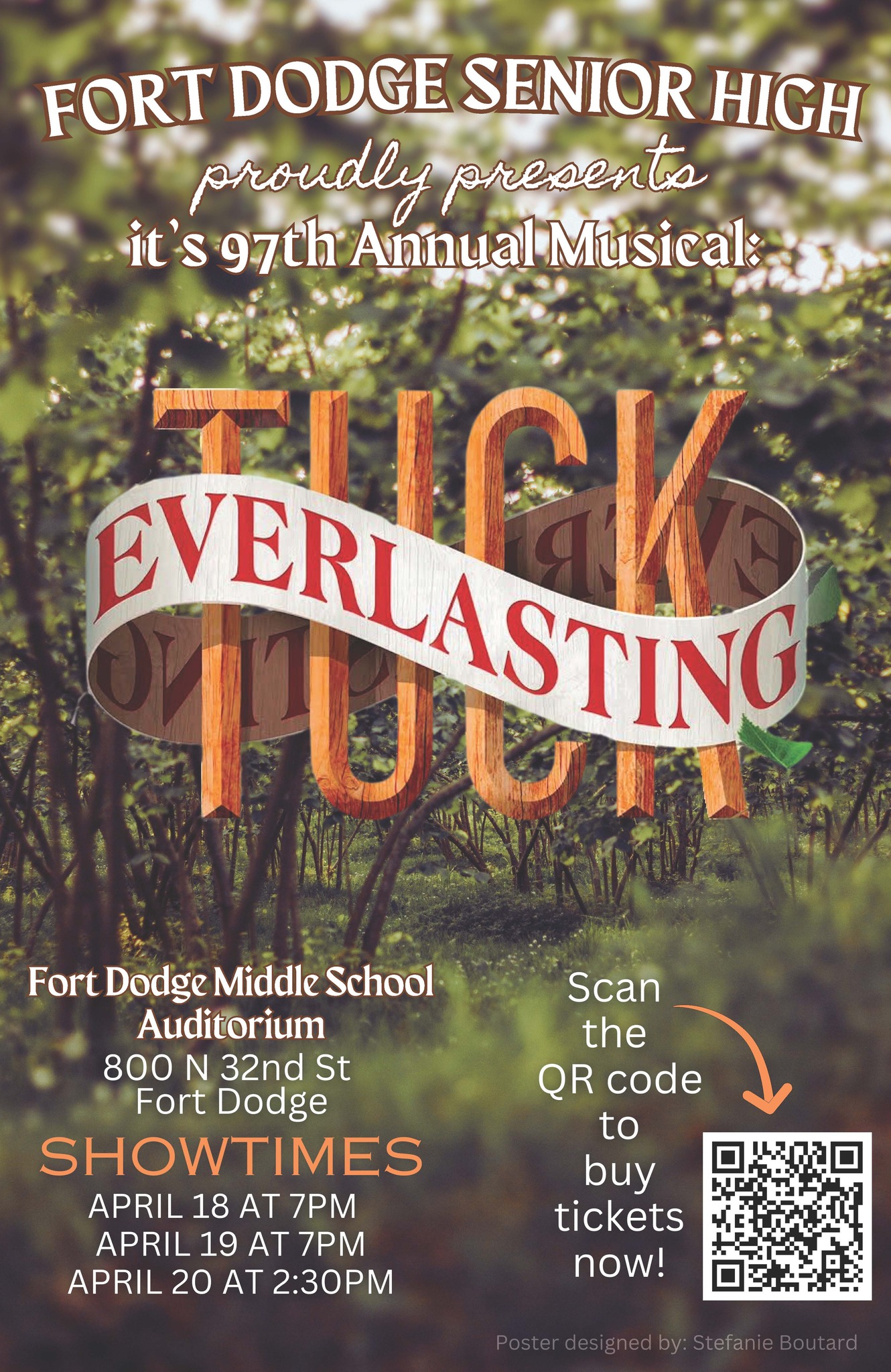

FD Senior High – Tuck Everlasting

FD Senior High – Tuck Everlasting

Get ready to be swept away on a timeless journey with the Fort Dodge Senior High School's […]

2 events,

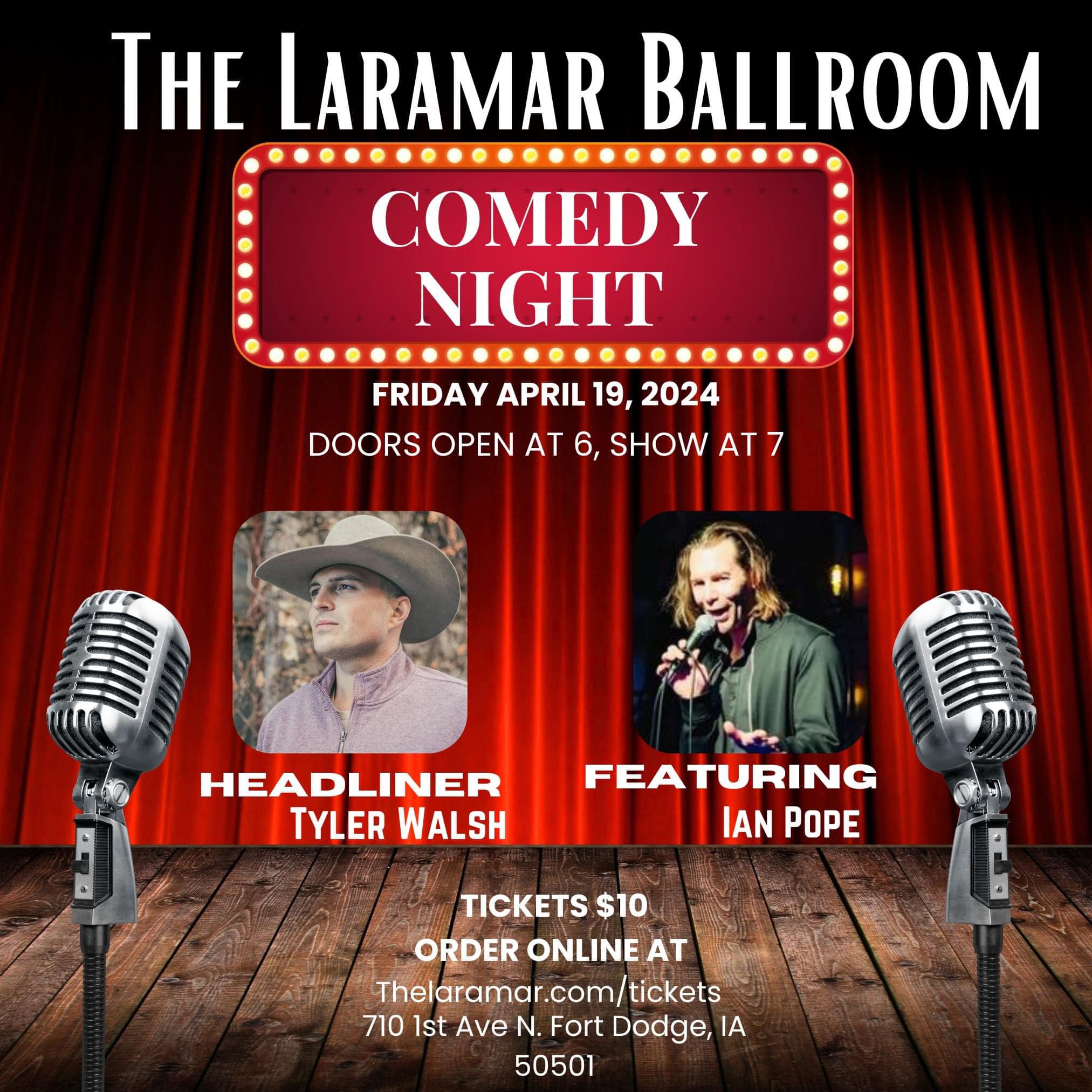

Comedy Night – Laramar Ballroom

Comedy Night – Laramar Ballroom

Ian Pope & Tyler Walsh will be at The Laramar Ballroom on April 19th!

FD Senior High – Tuck Everlasting

FD Senior High – Tuck Everlasting

Get ready to be swept away on a timeless journey with the Fort Dodge Senior High School's […]

4 events,

Duncombe Betterment Committee Spring Vendor Show

Duncombe Betterment Committee Spring Vendor Show

Calling all vendors & shoppers! You won't want to miss this!

Mats and More at OSUM Church

Mats and More at OSUM Church

Free-Will Offering luncheon. Explanation of woven mats being made for homeless and needy people. See attached article […]

FD Senior High – Tuck Everlasting

FD Senior High – Tuck Everlasting

Get ready to be swept away on a timeless journey with the Fort Dodge Senior High School's […]

Abate of Iowa District 10 Dart Tournament

Abate of Iowa District 10 Dart Tournament

Abate of Iowa District 10 Dart Tournament & Meeting. Get ready to throw some sticks at a […]

1 event,

Karl L. King Municipal Band Concert

Karl L. King Municipal Band Concert

Annual Scholarship Concert featuring High School Seniors/College Freshmen who audition for either a $500 scholarship to Iowa […]

0 events,

2 events,

Tom Hofer & The Iowa Playboys appear at Prairie Meadows

Tom Hofer & The Iowa Playboys appear at Prairie Meadows

Tom Hofer & The Iowa Playboys will be doing all of your favorite country, western swing, oldies […]

BIG DAWG BINGO

BIG DAWG BINGO

Almost Home Humane Society will be facilitating Bingo every Tuesday night from 6-10 PM at the Laramar […]

1 event,

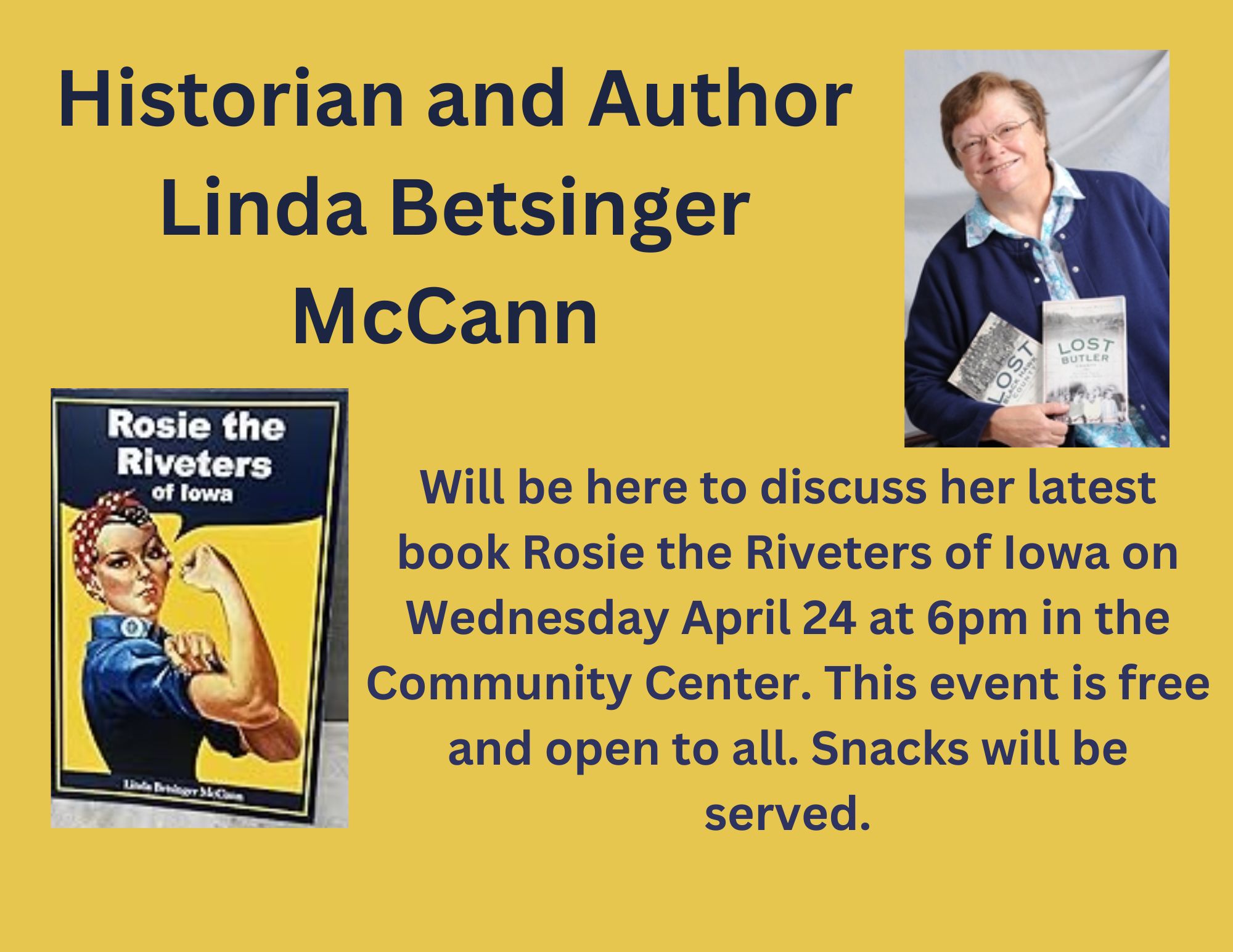

Rosie the Riveters of Iowa presentation by Author/Historian Linda McCann

Rosie the Riveters of Iowa presentation by Author/Historian Linda McCann

Historian and Author Linda Betsinger McCann will be here to discuss her latest book Rosie the Riveters […]

0 events,

0 events,

3 events,

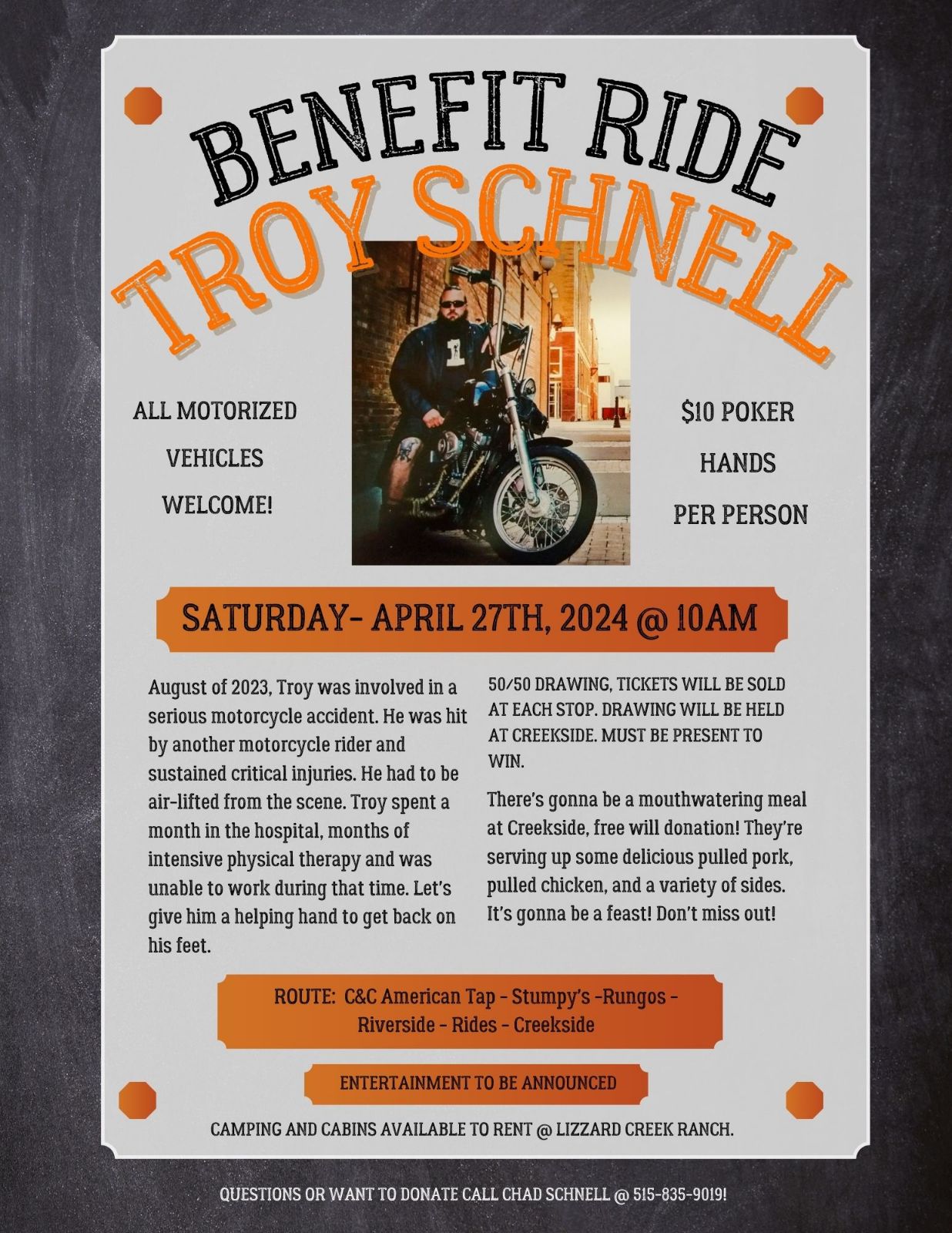

Benefit Ride for Troy Schnell

Benefit Ride for Troy Schnell

Benefit ride for Troy Schnell that was involved in a serious motorcycle accident.

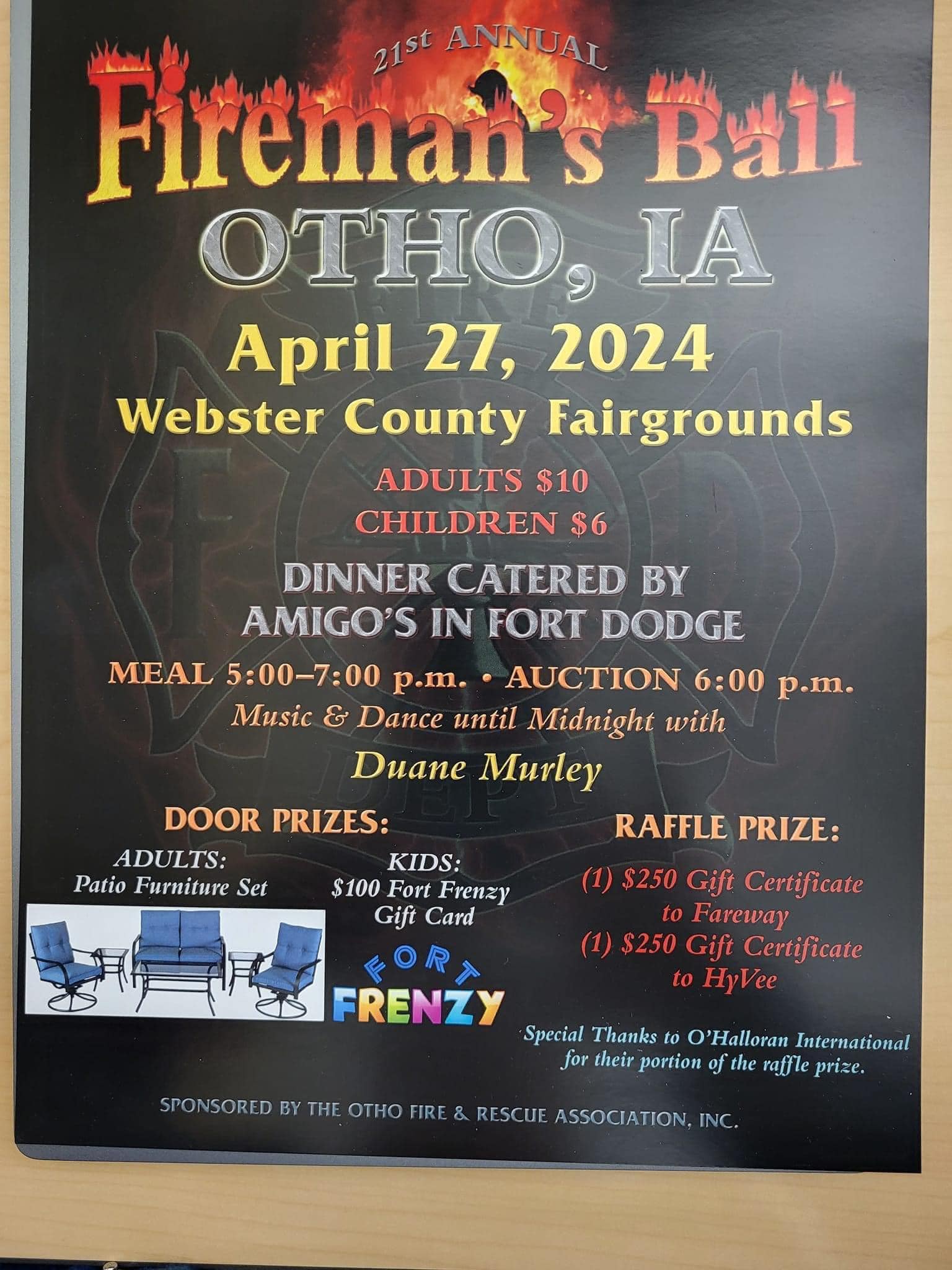

Otho’s Fireman’s Ball

Otho’s Fireman’s Ball

It's that time of year again, mark your calendars for Otho's Annual Fireman's Ball!

0 events,

0 events,

1 event,

BIG DAWG BINGO

BIG DAWG BINGO

Almost Home Humane Society will be facilitating Bingo every Tuesday night from 6-10 PM at the Laramar […]

1 event,

0 events,

0 events,

0 events,

0 events,

- There are no events on this day.

- There are no events on this day.

- There are no events on this day.

- There are no events on this day.

- There are no events on this day.

- There are no events on this day.

- There are no events on this day.

- There are no events on this day.

- There are no events on this day.

- There are no events on this day.

- There are no events on this day.

- There are no events on this day.

- There are no events on this day.

- There are no events on this day.

- There are no events on this day.